Can Small Businesses Charge for Credit Card Payments

All-time Credit Card Processing Services of 2022

Nothing affects your bottom line more than beingness able to smoothly accept payments from your customers. If you can't take payments, you can't make money, and then information technology'due south crucial to find a payment processing solution that fits snugly into your business model.

Some payment processing companies want to nickel and dime your small business with subconscious fees and deceptive rates. The last thing you need is to get into a long-term contract with a processing company that skims your transactions to make themselves some actress dough at your expense.

There are hundreds of payment processing companies, so to make your chore easier, nosotros've rounded upwardly six of the best payment processing companies operating today.

Best credit card processors of 2022

- : Best overall

- : Best pricing plans

- : All-time client service

- : All-time indicate-of-auction integration

- : Best for global sales

The best credit carte du jour processing for pocket-size business organisation

| Make | Basic Monthly fee | Learn more than |

|---|---|---|

| Square | $0.00 | Meet Plans |

| Payment Depot | $99.00 | See Plans |

| National Processing | $x.00 | See Plans |

| Stax | $99.00 | Come across Plans |

| Stripe | $0.00 | Encounter Plans |

Data equally of ane/27/22. Offers and availability may vary by location and are subject to change.

Best overall: Square

Data equally of ane/27/22. Offers and availability may vary by location and are discipline to alter.

It's hard to argue with the value Foursquare offers to small businesses. If you lot want to starting time processing payments today, y'all can go a costless mobile card reader from Foursquare past opening a free account on their website. As soon as your complimentary reader arrives in the mail, all you have to do is download the Square app, and you tin can start taking payments.

Foursquare does accept a higher price per transaction than other companies, but when y'all consider the fact that yous don't take to pay monthly and yous tin can become a free mobile credit card reader, the total difference in price may be negligible—especially for pocket-size businesses with lower transaction book.

In addition to existence a turnkey credit bill of fare processing solution, Square also offers a elevation-tier point-of-sale system. Inventory tracking, employee functioning monitoring, and rewards programs are just a few of the features available to your concern through Square's point-of-auction features.

Square besides lets you take payments in any and all formats for reasonable rates:

- In-person payments. Apply a mobile reader or any other Foursquare terminal to accept payments.

- Invoice payments. Email your customers a payable invoice for 2.9% + thirty¢ per invoice. You can set up these invoices upward to be recurring.

- Remote payments via reckoner. Have payments over the phone at a rate of 3.5% + 15¢ for all bill of fare-not-present transactions.

- Online payments. Build an online shop or integrate Square'south payment processor into your existing website for 2.nine% + 30¢ per transaction.

And retrieve, you're getting all this functionality for no monthly fee, making Square our top provider of credit card processing for minor businesses.

Payment Depot: Best pricing plans

Information every bit of 1/27/22. Offers and availability may vary past location and are subject to modify.

Payment Depot uses a tiered pricing programme designed to lower your processing rates as your sales volume increases. Each tier has a lower processing toll and a slightly college monthly payment. You tin can sign up for any tier you want, only lower tiers have a maximum processing book.

Payment Depot's has some of the cheapest rates nosotros've ever found. And normally we'd be a bit skeptical of rates so low, just after digging into the user reviews, we plant overwhelming positivity toward Payment Depot and its services.

Not only does Payment Depot offer great rates, but it too avoids charging unnecessary actress fees. Also, many of the plans come with free terminals. The Premier programme, for instance, comes with a free smart terminal or free premium gateway.

That said, because Payment Depot has a monthly fee, it'southward best suited for businesses that process credit cards at a fairly regular monthly volume. So, if you're brand-new to processing or your credit card volume is desultory, you may want to wait into a flat-rate processor with no monthly fee.

All-time customer service: National Processing

Data as of 1/27/22. Offers and availability may vary by location and are subject to modify.

Here'due south the quick-and-dirty of why you desire a payment processor known for their superb customer service:

- Gratis equipment reprogramming. If yous're looking to modify processing providers, integrating new services with existing equipment can exist a hurting. National Processing knows this, so they offer a total reprogramming of your equipment for costless.

- Chargeback monitoring. Chargebacks are an expensive burden to handle by yourself. National Processing monitors your chargeback risk, helping you avoid those costs.

- 24/7 customer service. With easy access to quality client service, y'all tin can residual assured someone volition be there anytime you have a problem or need some help.

In addition to offering industry-leading customer service, National Processing also provides highly competitive rates. At $10 a month plus a rate of interchange + 0.15% + 7¢ per transaction, y'all'll be saving a good deal of money. These savings can exist a game changer if you're operating at a higher sales volume.

Another way that National Processing helps you save is by offer you lot a complimentary mobile bill of fare reader called Clover Become when you sign up. Then you tin have payments on the become without paying for any new equipment.

If yous do desire new equipment, National Processing offers Clover Mini and Clover Station terminals that double as point-of-sale systems. This adds inventory management, promos, rewards, employee logins, and more.

Best point-of-auction integration: Stax

Data as of ane/27/22. Offers and availability may vary past location and are field of study to change.

Are you already using a point-of-sale system and don't want to switch? Good news, Stax integrates with 90% of all third-party solutions. Here are some popular bespeak-of-sale systems that Stax integrates with:

- Aloha

- Micros

- Revel

- Vend

Being able to integrate a new payment processor with your existing point-of-sale organisation is key if y'all don't want your workflow to exist disrupted. That's why Stax makes information technology like shooting fish in a barrel to switch your payment processor and keep your betoken-of-sale organisation.

Some other competitive edge that Stax brings to the table is its competitive rates. Stax charges only interchange + eight¢ per transaction with their last and integration plans and only interchange + 15¢ for virtual terminal, shopping cart, mobile, and API plans. That'due south almost as depression equally rates get, but there's one drawback.

Stax has the highest monthly fee of whatever of our recommendations at $99 per calendar month. This means Stax isn't for every business—specifically, businesses that don't accept plenty monthly credit carte revenue to relieve them coin with Stax's pricing model.

Simply Stax does offer all pop channels of receiving payment:

- Invoicing

- Card-nowadays transactions

- Remote estimator payments

- Online API

Stax is competitive in their offerings, but y'all should be sure to calculate if their pricing model volition salvage y'all money before you movement forrad.

All-time for global sales: Stripe

Information every bit of i/27/22. Offers and availability may vary by location and are subject to change.

Stripe is your best selection for selling wares or services around the globe using your website. No other payment processor even comes close to what Stripe offers in worldwide online sales.

This is why Stripe has a higher processing fee than some of our other recommendations. There's no monthly fee, which does offset some of the cost. Stripe knows it's a piddling more expensive, and that'southward why it offers features you can't become anywhere else.

Hither are a few key features of Stripe'southward payment platform:

- Global payment acceptance. Adding a single stripe API to your website will allow yous to have payments in over 135 currencies.

- Checkout optimization. Design a custom checkout interface that maximizes flow beyond desktop and mobile interfaces.

- Piece of cake website embedding. All yous need is a single line of JavaScript to embed a checkout box on your website.

- Worldwide security licensing. Your payments will be safe, legal, and compliant all over the world cheers to Stripe obtaining and renewing licenses across the globe.

- Programmed dispute treatment. This automates prove submissions for chargebacks using the Disputes API.

You lot can also choose to use some optional add-ons. Stripe offers in-person processing if you purchase ane of their terminals and allows yous to build custom checkout flows.

Stripe also offers credit card concluding processing. This isn't its specialty, but its rate is pretty reasonable at 2.vii% + 5¢ per successful charge. Still, if y'all're looking for a fully featured point-of-sale solution, Stripe's terminal and deject management software probably won't make the cut.

Besides, be aware that to implement Stripe, you demand a website and admission to a developer or web developer. Stripe is an online awarding that yous accept to integrate into your website. The only way effectually hiring a programmer is by designing a website on a web development platform that integrates with Stripe—similar Squarespace.

You can outset using Stripe for free today. Y'all only pay when you make sales.

Follow these steps to buy the perfect POS organization

Read our free ultimate checklist for finding the right POS for your business. Don't get saddled with the wrong arrangement. Enter your email and the checklist will arrive promptly.

Honorable mentions

These brands just missed our height 5, just you shouldn't miss out on giving them a look. Both are solid brands with something unique to offer small businesses.

Credit card processing honorable mentions

- : Most Scalable Rates

- : Nigh flexible contract

Honorable mentions pricing

| Brand | Basic Monthly fee | Acquire more |

|---|---|---|

| Helcim | None | See Plans |

| Dharma | $20.00 | See Plans |

Information equally of one/27/22. Offers and availability may vary past location and are subject to change.

About scalable rates: Helcim

Data equally of one/27/22. Offers and availability may vary by location and are subject to change.

Helcim's most interesting feature is the mode its rates calibration. The higher your monthly processing volume, the lower your rates.

Helcim pricing arrangement

| Monthly sales volume | Swipe, dip, or tap rates | Keyed and online rates | Learn more |

|---|---|---|---|

| $0–$25,000 | Interchange + 0.thirty% | Interchange + 0.50% | See Plans |

| $25,001–$fifty,000 | Interchange + 0.25% | Interchange + 0.45% | Run across Plans |

| $fifty,001–$100,000 | Interchange + 0.20% | Interchange + 0.40% | Come across Plans |

| $100,001–$250,000 | Interchange + 0.xviii% | Interchange + 0.35% | Encounter Plans |

| $250,001–$1,000,000 | Interchange + 0.15% | Interchange + 0.30% | See Plans |

| $ane,000,001–$5,000,000 | Interchange + 0.12% | Interchange + 0.25% | See Plans |

| $5,000,000+ | Interchange + 0.10% | Interchange + 0.20% | Run into Plans |

Data as of 1/27/22. Offers and availability may vary by location and are subject to change.

What'southward so notable about Helcim's rates is that there'due south no monthly fee despite the processing fees being relatively low. This gives Helcim a great value proposition. Not only will you lot save money if you process with them but don't accept consistent processing volume, you'll likewise save if your processing volume starts to be consistent and grows over fourth dimension.

In improver to great rates, Helcim has been consistently adding POS features to its service. It nonetheless doesn't have any loyalty tools, but information technology has ways to track inventory and manage your eatery. It has plenty extras to be competitive. That's why information technology's one of our favorite processing brands.

Most flexible contract: Dharma Merchant Services

Data equally of 1/27/22. Offers and availability may vary by location and are subject to change.

Dharma offers competitive interchange plus pricing at a low monthly payment. It may not be the everyman-priced provider, but what really sets Dharma apart is its contract flexibility.

So if you accept a seasonal business, Dharma won't charge you lot any fees for deactivating and reactivating your account for your express sales flavor. In fact, you're billed with Dharma on a monthly basis and tin freeze your business relationship at any time, meaning no long-term commitments.

The only fourth dimension you'll be charged is if yous decide to permanently shut your business relationship—there'southward a $25 processing fee. Compared to many other payment processors, this is a very small fee.

Another mode that Dharma competes with the all-time is past offering a fully featured merchant software that makes taking payments easy, allowing you to manage your payments from one elementary place.

And if you lot're taking those payments from a storefront or eating house, you can take advantage of Dharma's special credit card processing rate at 0.15% + 7¢ above interchange, making your statements elementary and easy to read and saving you money on processing costs.

Ready to start accepting credit cards?

Square lets you lot get started for complimentary. The account is complimentary, the app is costless, and your outset mobile card reader is free. Yous simply pay every bit you process.

The takeaway

Choosing a credit card processor can be tricky if you don't know what features you demand. If y'all're unsure where to start with processing, we recommend trying out Foursquare. It's our number 1 choice because it does a trivial bit of everything without long-term contracts or monthly fees. If Square's services don't quite fit your bill, it's easy to switch over to another recommended brand:

- National Processing volition make the transition seamless with best-in-grade client service

- Stax will help you add cheap processing services to your current POS arrangement

- Payment Depot will help you process at the lowest possible price on the market without sacrificing quality of products or services

- Stripe will requite yous the power to exercise business across the world online

We've handpicked each of the brands above because they have reputable track records and a history of helping small businesses. Whatever of them will get your payment processing chore done right.

If you're looking for extra signal-of-sale features and desire more merely a way to process credit cards, be sure to check out our recommendations for the best pocket-size-business organisation signal-of-auction systems.

FAQs

Where practise I find interchange rates?

Yous can find all current interchange rates on Host Merchant Services' website. These rates are subject to alter from month to calendar month, so if you're using a credit card processor that uses interchange-plus rates, yous may see small-scale fluctuations on your statements.

Can I integrate my payment processor into my website?

Many of our suggestions in a higher place offering APIs that tin can easily be added into the code of your website. Some are more customizable than others and may even offer a loose plenty template to allow for branded payment processing.

What'southward the departure betwixt credit card processing and point of sale?

Credit card processing simply describes your ability to accept credit cards. This is usually washed through a processing provider that works with credit carte companies to pay interchange rates and stay PCI compliant.

Point of sale, on the other paw, often includes credit card processing, simply it also includes a number of other features relevant to making a sale, like inventory direction, rewards programs, and employee tracking.

Many credit card processing companies, like Square, likewise offer a suite of indicate-of-sale features that are oftentimes needed for customer purchases.

Practise you have any other questions most credit card processing?

If yous do, don't hesitate to email usa, and one of our processing experts will update this page with an reply to your question.

Our methodology

We've vetted these companies with modest-business owners in mind, looking for traits and features that best serve minor-business organisation needs, like these:

- Ease of integration. How like shooting fish in a barrel is it to start taking credit carte payments? How long is the sign-upward and integration process? Will this processor integrate with your existing equipment?

- Fees and costs. What'due south the cost per swipe? Are in that location any fees for chargebacks? Are there any fees for early on account termination? Are there monthly fees?

- Customer service. Is it easy for a customer to contact customer service? Are the service representatives effectively resolving issues as they ingather upwardly?

- Multi-channel functionality. Does the processor allow for mobile payments, in-store payments, or over-the-phone payments?

- Manufacture expertise. Does the brand offer any plans suited to the needs of specific industries, like retail or eating place?

Credit Card Stats and Trends

Economical changes during the pandemic take afflicted countless industries and caused major upsets in global markets. The credit menu industry is one of many that has seen both pregnant and slightly distressing changes—especially amongst user spending habits.

Let'southward dive into the data on what exactly has shifted since our earth got flipped upside downwardly.

What has changed since the pandemic?

More than one-half of Americans (62%) say their credit card debt has increased since the beginning of the pandemic, with 52% saying they've increased their credit limits to back up their growing spending habits. This is one of many worrisome statistics we'll dive into.

Debt is on the rise, but despite individual financial situations becoming more precarious, spending as a whole doesn't seem to be slowing down.

In fact, there are many industries whose overall sales take increased since the get-go of the pandemic:

- Sporting goods, hobby, musical instruments, and book stores (39%)

- Building materials and garden equipment (38.8%)

- Electronics and appliance stores (35.two%)

- Automotive parts, accessories, and tire stores (27.nine%)

- Furniture and dwelling effects stores (22.6%)

Only with these increases accept come a few notable decreases:

- Amusement, gambling, and recreation industries (-14.three%)

- Food services and drinking establishments (-xviii.1%)

- Accommodations (-27.half dozen%)

These spending-addiction shifts in addition to growing credit carte debt led united states of america to wonder why exactly individuals are choosing to use credit cards.

What stresses Americans about credit cards?

Credit cards are obviously not a magical fountain of coin—they come up with strict terms. Due to increased demand for credit cards, there's every reason for credit card companies to offer less forgiving terms.

Credit card users are experiencing suboptimal terms, with 64% being stressed virtually loftier interest rates and 47% worrying nearly annual fees. Additionally, 41% of credit card users are also worried about increasing debt and 25% are concerned over making monthly payments.

As if these worries weren't enough, Americans' particular spending habits bespeak that credit cards are being used carelessly.

What are common credit menu spending habits?

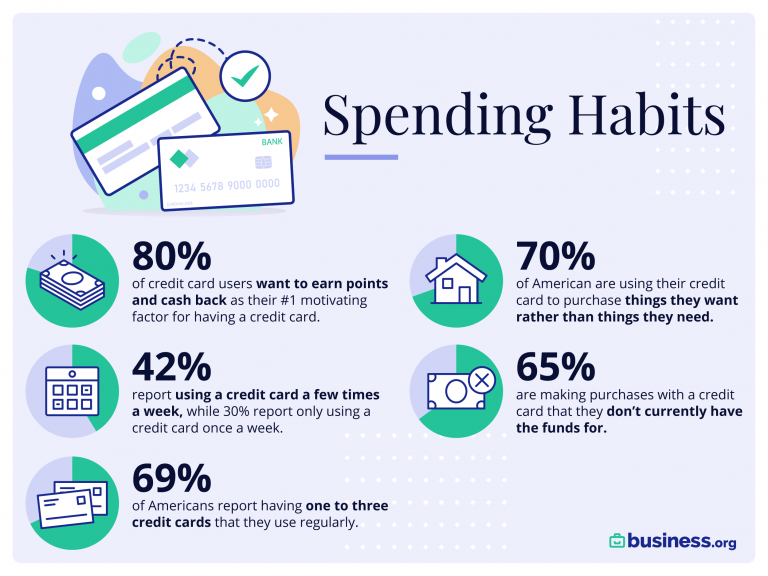

Among cardholders, 70% are using credit cards to buy things they want rather than things they need, with 65% making purchases they don't currently take the funds for. Americans are digging themselves into debt by purchasing not-essential items.

This is worrisome simply not entirely unexpected, as pandemic boredom has played a role in increasing entertainment spending. Demand for gaming consoles is at an all-time high, simply microchip shortages take led to panel shortages. These factors accept led many to purchase marked-up gaming entertainment systems on credit cards.

And Americans aren't merely using one credit carte du jour to brand purchases—69% of Americans written report having one to three credit cards that they use regularly. Moreover, 42% report using a credit card a few times a week and thirty% apply a credit carte in one case a week. With so many people using credit cards, in that location's been an uptick in worries nearly credit card safety.

How condom are credit cards in 2021?

Most Americans (59%) study concerns about having their credit bill of fare data stolen, with 52% reporting that they've had their credit card information stolen at least in one case. That yet leaves 48% of people who oasis't had their credit card data stolen—which is a great number—but the business concern nigh safety is not unfounded.

Because online purchases have increased since the start of the pandemic and credit carte information is being shared in more places online, there'due south no wonder why people are concerned.

The takeaway

Credit cards are condign a more meaning part of American spending habits. That said, it seems that many cardholders are using credit unwisely, purchasing non-essential items that they don't have the funds to cover. If this trend continues, some Americans may find themselves with some serious debt problems.

Because of this, it's crucial to educate new cardholders on safe and smart spending practices and then they can avoid unnecessary debts. Otherwise, we may notice ourselves with a personal debt crisis.

Methodology

We partnered with Pollfish to deport an anonymous survey of 700 Americans. Business organisation.org analyzed the results and compiled this written report. To learn more about Pollfish and how it organically finds respondents, check out its methodology.

Disclaimer

At Business concern.org, our research is meant to offer general product and service recommendations. Nosotros don't guarantee that our suggestions will work all-time for each individual or business concern, and so consider your unique needs when choosing products and services.

Back To Top

Source: https://www.business.org/finance/payment-processing/best-credit-card-processing-for-small-businesses/

0 Response to "Can Small Businesses Charge for Credit Card Payments"

Postar um comentário